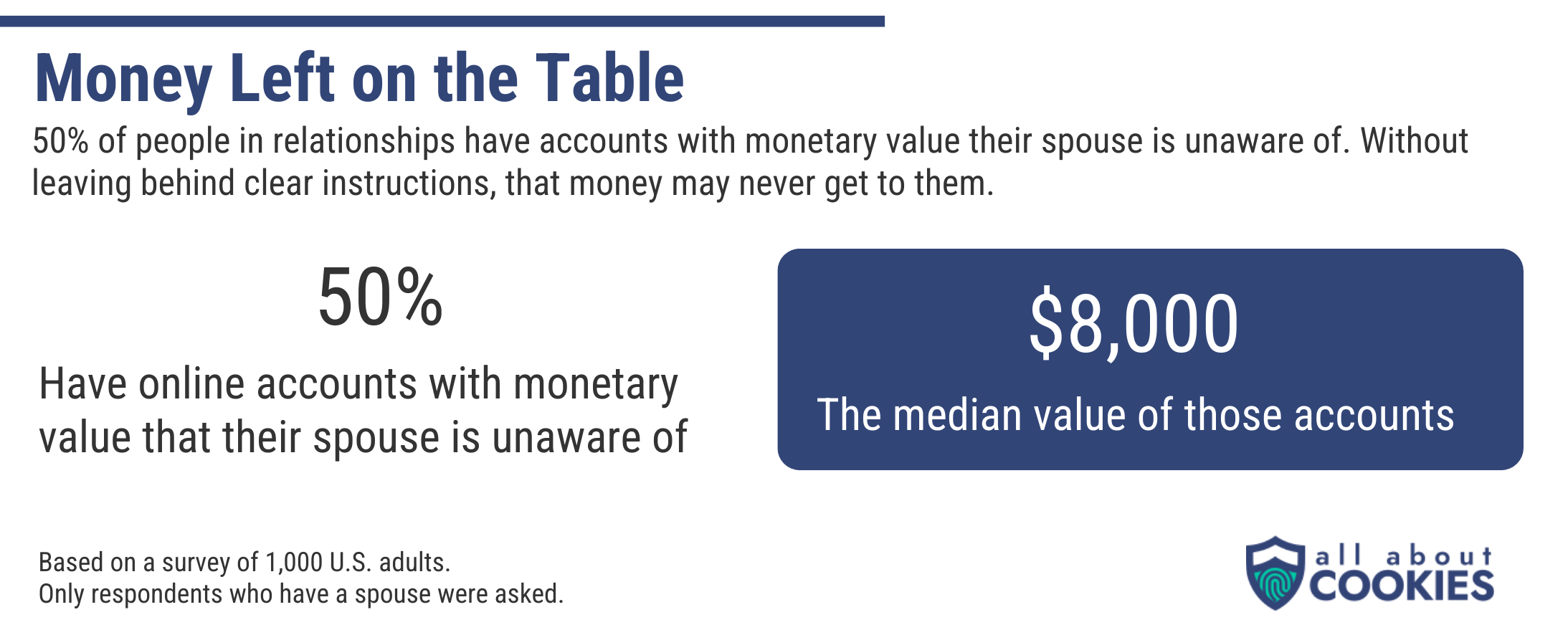

Georgy Timoshin // Shutterstock You already know having a will is important. Personal assets like homes, cars, jewelry, and other physical items need a place to go after you’re gone. But what about your digital assets? Phone and computer passwords, crypto wallets, investment portfolios, mobile banking passcodes, and even social media credentials also need a place to go when you die. In a lot of cases, these accounts may be even more important than some physical assets, and unless you’re using a password manager, these key details are likely scattered across devices, your brain, or even handwritten notes around your home. But how many people actually have a plan for their digital assets? Our team at All About Cookies surveyed 1,000 U.S. adults on the topic and found out how prepared Americans are to pass on their digital inheritances, how many people have even considered it, and even how much value Americans are leaving unprotected in the worst-case scenarios. Key Findings 67% of surveyed internet users have a plan in place to share login or password information for their banking accounts in the event they pass away, but not necessarily in a formal will. Of the 65% of people who had a will, only 24% included any online account information. Only 30% of people in relationships who were surveyed say their partner could easily access their online accounts in the event they passed away. 50% of married people have money in online accounts their spouse doesn’t know about. The median value of these accounts is $8,000. What digital assets do internet users make arrangements for? Almost everyone understands the need to dictate where their belongings will go once they’re gone. Social media has been around long enough for us to see how a page is archived when a person dies, but how many people have accounted for other tech assets? Our research shows around 1 in 3 of surveyed respondents have no plans at all. Gaps remain in digital asset protection All About Cookies Banking accounts and apps are the highest on the list, with 67% of respondents making arrangements to pass those on. Considering most adults understand the need for secure online banking while they’re using their accounts, it still means 1 in 3 respondents are leaving their financial info unspoken for. 57% of respondents planned to pass on credentials for bills or utilities. This is especially important for couples or people who share the same living space who would have to deal with red tape just to make sure the electricity stays on or they aren’t locked out of the Wi-Fi, while also dealing with their loss. For those under the same roof, some password managers for families allow multiple logins that share access to key details in the event the primary account holder isn’t able to access needed info. Personal websites and business accounts were also low, with just 35% and 31% of respondents having made plans for these assets, respectively. Blogs and merchant websites have the potential to generate a ton of revenue and should be treated the same as a physical business. Finally, digital estate accounts like email, phone, computer passwords, and even social media accounts should all be left with an heir in mind. All of these accounts will be necessary to settle someone’s estate. The fact that 61% or less of the people surveyed have a plan for these could leave many grieving families in the lurch. How people store digital assets All About Cookies While the vast majority of people have digital assets, we asked how the passwords tend to be stored. Respondents could select multiple options. A whopping 39% of people store their digital information in their heads. That tells us two things: Almost 40% of Americans have no way of sharing important information in case of emergency or incapacitation. 39% of people are likely using very simple, hackable passwords because they’re easy to remember. Obituaries are public, and there’s nothing stopping a hacker from taking advantage of the deceased through ghosting identity theft schemes. The need for keeping passwords safe is especially important for seniors, who already have an increased likelihood of being targeted by identity thieves. In these cases, setting up an easy-to-use password manager for seniors could be the difference between preventing loss and allowing bad actors to take advantage of a tragic situation. Though it’s good to see that the majority of people are storing at least some of their passwords digitally, it’s important to understand if they’re simply using their browser’s autofill feature, on a device, or actually subscribed to a highly encrypted password manager. With more and more people opting into device-specific methods to store passwords like the new Apple Passwords app on the iPhone, it’s important to share access to this information in the event someone can’t access your device. Apple Passwords has the built-in ability to share all or a portion of your passwords with family members. On top of having extra security, some of the best password managers have a digital heir feature, which means your information can be automatically sent to your designated contact without them having to wait for wills, probates, or any other legal process to execute. Who we share accounts with All About Cookies 42% of people share login credentials with a spouse, while only 13% have shared with a parent and 8% with a friend. Considering all the singles and roommate situations out there, this low number means that the majority of non-married people haven’t planned ahead. Even more concerning, 34% of people haven’t shared their digital assets with anyone. The future of these accounts and all the assets held within them are jeopardized if there’s no plan for them after you’re gone. Even if there isn’t a single person you want to share your data with right now, another option is sharing them with an attorney or estate executor, but only 3% of respondents say they’d actually done that. Depending on the state, assets will usually be passed to spouses (but not long-term partners) and children. If no heirs are identified by the state, the government can actually take everything you own. This is why designating what goes where and to whom is such an important step to take. Where there’s a will, there should be online account information All About Cookies Only 24% of respondents mentioned their online accounts in a will. While 41% had a will but didn’t mention online accounts, 35% didn’t have anything. With 3 in 4 Americans who took the survey, not having any designation as to where their digital inheritance will pass, we’re wondering what accounts may likely disappear or live untouched. Leaving behind a mess All About Cookies Most people’s closest confidants are their significant others, so we asked people in relationships how easy they’ve made it for their partners to access their accounts. 46% of people surveyed said that their loved one would be able to figure it out eventually. Remember, however, that grief works differently for everyone, and spending a week or two hunting for the bank password could leave someone financially strapped while also dealing with funeral plans, costs, and the emotional toll of it all. For the 24% of respondents who said it would be somewhat or very difficult for heirs to access accounts, loved ones will likely have to deal with tech companies or corporations and go through mountains of red tape to recover that information. Remember that for some passwords that require two-factor authentication, your loved ones would also need access to the authenticator app or text and email accounts receiving authentication passcodes. Likewise, if you’re using any type of passwordless authentication like Face ID or fingerprint access on your devices, you’ll need a backup in the event someone needs to access your device. What gets left behind? All About Cookies Do you have an account with funds that your loved ones aren’t aware of at all? Are you into sports betting? What about online games where you win real money? Do you dabble in crypto or online investment accounts? What would happen to all of those if you suddenly stopped logging in? When asked, exactly half (50%) of respondents said they had accounts of monetary value that their partners didn’t know about. Respondents had a median value of $8,000 in online assets that would either get lost or delayed on its way to their heirs. In fact, there’s a good chance those funds would never see their intended recipients. That’s more than just a chunk of change! Making plans to remember your legacy Digital legacy planning isn’t as difficult as you might think. Apple iCloud keychain users have the ability to designate an heir directly from their phones, while many password managers provide legacy contact or digital will features. The cost of digital planning tools like password managers is significantly lower than traditional estate planning, so you won’t need to worry about incurring a large bill to protect your loved ones. All it takes is a little time and organization to provide your heirs with this essential plan. Methodology All About Cookies surveyed 1,000 U.S. adults above the age of 18. Responses were collected in May 2024. This story was produced by All About Cookies and reviewed and distributed by Stacker Media.

What happens to your passwords when you die?