simon jhuan // Shutterstock With inflation and interest rates rising, many people are looking for ways to generate additional income these days–and finding reliable sources of passive income, which require less effort than most jobs–has become particularly desirable–SoFi reports. Creating and managing passive income streams isn’t a truly passive activity, however. Generating passive income usually requires upfront work, or sometimes a substantial investment to get the ball rolling. Depending on what your passive income ideas are, whether you’re renting out property or selling a product via online platforms, you’ll likely have ongoing tasks to keep the money coming in. That said, passive income can, in some cases, deliver more income with less effort than a traditional job that requires a fixed number of hours per week. Key points: Passive income is money earned without active involvement. High-interest savings accounts, investing in business, P2P lending, and rental properties are some ways to generate passive income. Benefits of passive income include extra money with less effort, freedom, and flexibility. Initial work and investments are often needed to set up a stream of passive income. The opposite of passive income is active income, which usually involves a job and is also known as earned income. What Is Passive Income? Passive income is money earned without active involvement. In other words, it is income that isn’t attached to an hourly wage or annual salary. Passive income ideas could include things like cash flow from rental properties, dividend stocks, sales of a product (that requires little or no effort), royalties, and more. Essentially, these side hustles can help you earn money without contributing much, if any, active effort. If you are paid for a service you perform, that’s active income–you have to put in time and energy in order to get paid. If you can continue making money while staying mostly hands-off, that can be a form of passive income. That doesn’t mean you won’t have to put work in up front to get started–you probably will. But besides some maintenance, passive income shouldn’t require active involvement. There are obvious benefits to these low-effort side hustles over traditional active income. Earning more money without putting in more hours offers the opportunity to make extra cash without burning yourself out. If you’re successful enough, it might even give you the freedom and flexibility to quit your day job and do whatever you want instead, whether that’s going to school, traveling, writing, or making art. 39 Passive Income Ideas to Help You Make Money There are a number of ways to earn passive income. Some options, like the following types of passive income, take relatively little active supervision. 1. Open a High-Yield Savings Account A high-yield savings account is an alternative to traditional savings accounts, and they’re attracting more attention these days thanks to higher interest payments that might be 2% or more. By simply putting your money in the bank, you may be able to start to earn passive income on it. If you invest in an FDIC-insured account, the first $250,000 of your money is protected. There are both banks and online platforms which offer a high-yield savings account. Savings accounts are generally appealing because they are a separate place to store money you don’t necessarily want to use on day-to-day expenses. For example, it could be a good place to save for emergencies, or even to save for a vacation or a move across the country. When you find a high-interest savings account, take a look at the fine print. What conditions are attached for you to get that rate? The financial institution may require you to have a certain amount of money deposited into that account each month, maintain a certain balance, or have your bills automatically deducted from it. You may need to use your debit card a predetermined number of times, as yet another example–or be limited in the number of transactions that can take place each month. 2. Invest in a Business Although this may take an upfront investment, buying into a business and becoming a silent partner can be another passive income source. Even if the company you are thinking of investing in seems solid, it’s important to have an understanding of the challenges the organization may face. There are some red flags to look out for, such as a company whose revenue is earned from just a couple of clients–or just one client–as opposed to several. It’s also important to lay out the exact terms of your investment and compensation. 3. Become a Peer-to-Peer Lender Peer-to-peer lending platforms are another type of crowdfunding that allows people to borrow money from individual investors. Through these sites, you can be matched with an individual seeking a loan, and lend your money at a rate that could be higher than the usual bank rates. That’s because investors taking part in peer-to-peer lending tend to bear the bulk of any risk. It is possible that borrowers will default on their loans, leading to a higher risk if an investor were to lend money with a lower credit rating, for example. Returns are never guaranteed and while investors will receive a return on the money they invest, they could also lose some or all of it in the long run. 4. Buy a Rental Property Another popular passive income source is rental property. You might want to purchase a home to rent out to an ongoing tenant or list a property on a short-term rental site. Hiring a property management company lessens your day-to-day involvement, thereby making this venture a more passive income strategy than active. Obviously, setting up this type of income requires a pretty big outlay, and it may be a while before your investment property generates a profit over and above the many expenses required to run it. In addition, there are always risks in the rental markets to keep in mind. 5. Invest in Crowdfunded Real Estate If you don’t have thousands of dollars to spend on a piece of property, you can always check out your options on crowdfunded real estate sites. These may require a smaller initial investment, and likewise, the costs are also shared. Crowdfunded real estate investments can be complex, however, and you’ll want to balance the risks and rewards. 6. Invest in Dividend Stocks SoFi When companies choose to share a portion of their profits with the investors who own shares of the firm, those payments are called dividends, and they work generally the same way from company to company. Typically, dividends are paid in cash (though some might be paid in stock) on a regular schedule. Dividends are usually paid quarterly, though there are variations. Investors might receive dividends from companies they’re invested in, or from mutual funds they’re invested in that hold shares of dividend-paying companies. There is no guarantee that investing in dividend stocks will continue to earn you passive income. As Liz Young Thomas, head of investment strategy at SoFi, points out, “A stock’s dividend yield will fluctuate because it’s based on the stock’s price, and prices can be volatile. You should also consider other factors like a company’s track record of increasing the dividend, the dividend payout ratio, debt load, and cash on hand when determining the overall health of an investment.” 7. Invest With an Automated Advisor If you’re just getting started with investing, you may want to use automated investing tools to help you choose the appropriate allocation of assets for your goals. Typically, an automated platform–also called a robo-advisor–is a digital investing service that provides you with a questionnaire so you can establish your financial goals, risk preferences, and time horizon. On the backend, a sophisticated algorithm then recommends a pre-set, automated portfolio that aligns with your responses. These portfolios often have lower account minimums compared with traditional brokers, and the portfolios themselves are typically comprised of low-cost exchange-traded funds–which adds to the cost efficiency of some robo-products. You can use a robo-investing as you would any account–for retirement, as a taxable investment account, or even for your emergency fund–and you typically invest using automatic deposits or contributions. The allocation in each portfolio is usually pre-determined, and investors cannot change the investments. 8. Start a Retirement Account When you open your retirement account, you can choose to invest it however you want. For example, you could open an individual retirement account. One way to earn income in a retirement account is by investing in mutual funds. You can choose the level of risk you want to take with your money by finding a mutual fund that is higher or lower risk. 9. Join an Affiliate Program When you join a company’s affiliate program, you earn a commission from every product that someone purchases from that company. All you have to do is post the link on your blog, website, or social media pages. Amazon Associates is a great place to start. 10. Rent Out Your Car Another one of the best passive income opportunities is renting out your car on a site like Turo. It’s basically the Airbnb of cars, and, according to Turo, the average annual income for one car on the site is $10,516. 11. Advertise on Your Car If you have a clean driving record as well as a newer car, consider getting in touch with a car advertising agency. You simply drive around town with ads on your car and easily generate passive income. 12. Rent Your Parking Space Do you have space in your driveway that you aren’t using? Then rent it out on platforms like Stow It, where you can find people who will pay to rent out the space. 13. Rent Storage Space If you have extra space in your garage, shed, or storage unit, then you could start earning passive income by using a peer-to-peer storage site like Stashii to find people who need your space. 14. Invest in Real Estate Investment Trusts An alternative to becoming a property owner or landlord are real estate investment trusts, or REITs. REITs are publicly traded companies on the stock market that own income-producing real estate. They give you the chance to invest in real estate portfolios. REITs sometimes come at a higher risk than other funds. You might consider investing in a REIT that focuses on storage units. For example, one option is Public Storage, which has ownership or interest in 2,548 properties located in 38 states. For more alternative investment options, check out: Alternative Investments: Definition and Types 15. Rent Your Bike Perhaps you don’t have a car, but you do have a bike that’s just sitting around. Your bike could be a lucrative passive income source, especially if you live in a high-traffic area. List your bike on Spinlister to get started. 16. Airbnb or Rent Out a Room Even if you don’t own an investment property, with your landlord’s permission, you may be able to rent out a room in your apartment or list it on Airbnb. 17. Pet Sit in Your Home If you love pets, you can earn passive income by welcoming pets into your home while their owners are on vacation. For instance, you could charge $30 to $80 per day just for running a doggy daycare. You can gain clients through word of mouth or use a site like Rover to find customers. 18. House Sit for Someone When your friends go out of town, they may need someone to stay in their home and do simple things like water their plants and collect their mail. You can easily make money and have somewhere new to stay for a little bit. Along with making yourself available to friends, you can sign up to be a house sitter on HouseSitter.com. 19. Buy and Sell Domain Names Some domain names are cheap, while others cost a lot of money because they are in high demand. One thing you could do to start another passive income stream is to purchase domain names you think will be popular. Purchase low for around $10 to $100 and then sell them for a much higher price later on. 20. Rent Your Tools Have you ever done a home improvement project that required you to purchase tools? You may never need to use those tools again. Thankfully, now you can rent tools, and rent out your tools, on peer-to-peer platforms such as Sparetoolz to earn passive income. 21. Invest in Royalties Let’s say you don’t have any songwriting ability, but you would like to make money on other artists’ work. You can invest in royalties through Royalty Exchange and earn passive income on the intellectual property. 22. Purchase a Billboard You can make thousands of dollars per month if you own a billboard where companies can advertise their products and services. Do your research and make sure you get the right permits before committing to a billboard. 23. Purchase a Blog If you don’t have the time or energy to create content for your own blog, then look into ones that are already successful and see if the owners are willing to sell. You could also hire someone to manage your blog so that you’re truly earning in a passive way. 24. Create an Online Course If you have a special skill or knowledge about a certain topic, you may be able to create a video course where you teach people about that topic and charge them to take the course. 25. Sell Digital Products You may want to research online platforms where you can sell everything from digital art to e-books. Whether you’re an artist, graphic designer, or writer, you can create digital products to sell online. 26. License Your Photos Many companies, bloggers, and individuals use stock photos on a regular basis. You may be able to upload your best photos to stock media platforms and earn passive income on them. 27. Create a Mobile App If you’ve been dreaming about an amazing phone app that you think a lot of other people would use, you may want to look into hiring a development team to create it. 28. Sell a Product You may be able to earn passive income through sales of a product that you create. This could be a book that you write or a physical product that you design and make. You might also list items you already own on sites like eBay and earn extra income through those sales. 29. License Your Music Do you love to write songs? Then you could license your music and start earning passive income. You’ll just have to team up with a music licensing company to get started. 30. Self-Publish a Book Through platforms like Amazon’s KDP, you can self-publish a book and earn a royalty on it every time someone makes a purchase. You will be able to set the price of your book and be in full control of your book’s Amazon page, where you can list pictures of the book, reviews, and videos promoting it. 31. Sell Blank Books You can start selling books online without having to write anything. How? By focusing on blank books, such as journals, sketchbooks, and planners. Simply find a design you believe will appeal to people and begin collecting royalties when people buy your books. 32. Create Greeting Cards Another artistic endeavor that could be a good passive income stream is creating greeting cards that you sell to a wholesale or retail stationery company that accepts independent artist submissions. 33. Sign Up for Dropshipping If you want to sell products and make money online but don’t want to store any of the goods, you could always look into dropshipping to create passive income. With dropshipping, you don’t have to have much money to start since you don’t need inventory to fulfill orders for customers. 34. Start a Blog Blogging is a pretty cool space to operate in and gives you a lot of creative freedom. You can make your blog all about crafts, share tutorials, ideas, and more. It’s up to you how your space operates. Blogging might seem like too much work to many people, but it doesn’t have to be a full-time job for everyone. For some people, blogging can be fun after a day at the office–and, with time and effort, it could turn into something more lucrative. Here are a few ideas on how you can make passive income from blogging: Affiliate marketing Google AdSense: Cost per click and cost per impression Sponsored posts Selling products 35. Start a YouTube Channel If you enjoy creating videos more than writing, then consider starting your own YouTube channel. Once you get enough viewers, you can begin to generate passive income through YouTube advertising. 36. Publish an Ebook Like an online course, an ebook is a way to share your expertise with the world. Anyone can self-publish a book online through services like Amazon’s Kindle Direct Publishing, iBooks Author, or Kobo Writing Life. The percentage of royalties you earn varies depending on the publisher. Of course, the more marketing you do, the more copies you’re likely to sell–and there’s no shortage of online marketing strategies to investigate. But once you write and publish the e-book, it’s out there, ready to generate passive income for you. 37. Create a Podcast Podcasts are still popular, and they can generate some passive income for you. If you start a podcast that resonates with people, then you can grow your audience and monetize your show by sponsoring with ad partners. If you get enough listeners, you may be able to sign up for podcast advertising networks. 38. Start an ATM Business When people are out at a bar or nightclub, or they’re frequenting a cash-only business, they may need cash right away. If you own an ATM business and you place your ATM in high-traffic locations, you could start to generate passive income through surcharge fees. Typically, you could earn around $3 per withdrawal. 39. Start a Vending Machine Business Similar to an ATM business, a vending machine business allows you to use your creativity and determine high-traffic areas where you could make a lot of money. If you buy in bulk, you’ll be able to save on the snacks and drinks you purchase for your machines. Potential Benefits of Earning Passive Income There are only 24 hours in a day. If you go to a job each day that pays you a set amount of money, that is the maximum amount that you’ll ever make in a 24-hour period. That is called earned income. By investing some of that earned income into different passive income ideas, you may be able to increase your earnings. Diversifying your income stream may also improve your financial security. Some benefits of passive income are: More free time: By earning money through passive income sources, you might be able to free time in your schedule. You may choose to spend more time with your family, pursue a creative project or new business idea, or travel the world. Financial security: Even if you still plan to keep your 9-to-5 job, having multiple sources of income could help increase your financial security. If you lose your job, become sick, or get injured, you may still have money coming in to cover expenses. This is especially important if you are supporting a family. Tax benefits: You may want certain legal protections for your personal assets or to qualify for tax breaks. Consulting with an attorney and/or tax advisor to explore setting up a formal business structure like a sole proprietorship, a limited liability company, or a corporation, for example, might help you decide if this is a good route for your particular situation. Location flexibility: If you don’t have to go into an office each day, you’ll be free to move around and, possibly, live anywhere in the world. Many streams of passive income can be managed from your phone or laptop. Achieve financial independence: The definition of financial independence is having enough income to cover your expenses without having to actively work in order to cover living expenses. This could allow you to retire early and have more freedom to live your life the way you choose. Whether you’re interested in retiring early or not, passive income can be one way to help you reach financial independence. Pay off debt: Passive income may help you supplement your income so that you can pay off any debts more quickly. Potential Downsides of Earning Passive Income Although it might sound like a dream come true to quit your job and travel the world, earning through passive income is not quite that simple. Earning passive income is not a passive activity: Whether you’re generating passive income through a rental income, running a blog, or in another way, you will still need to put in some time and effort. It takes upfront investment to get these income sources up and running, and they don’t always work out as planned. If, for example, you run an Airbnb, you have to maintain the property, ensure a high-quality experience for guests, and address any issues or concerns guests may have to secure positive reviews. Passive income requires diversity: In order to earn enough passive income to quit your job and cover all your expenses, you would most likely need more than one source of income. Although you may no longer need to clock into a 9-to-5 job, you will likely still need to spend time managing multiple income streams. It’s lonely at the top: It might sound great to never have to go to the office again and to have the freedom to travel, but earning money through passive income can become lonely. Not having anyone to talk to during the day might make you feel lonely, and if you aren’t self-motivated, you may find it difficult to stay on task if you need to manage your passive income streams. Getting started may require investment: Depending on how you plan to create passive income, it may require an initial financial investment. You may need money for a down payment on an investment property, the development of a product you plan to sell, or for investment into dividend stocks. Managing Passive Income Streams No matter which type of passive income you choose to pursue, it’s important to keep track of your personal finances and both your short-term and long-term financial goals. Tracking multiple sources of income in a monthly budget can be a complex task. To be profitable, it’s important to pay attention to how much money you put into the maintenance of your passive income stream(s), such as property upkeep or monthly online services. The Takeaway Establishing passive income streams is one way to diversify your income and can help you build wealth and achieve financial freedom in the long term. There are a variety of ways to earn passive income, such as through investing, rental properties, and automated investing. Some passive income sources require a financial commitment or upfront investment, such as purchasing a rental property, and others may require a time commitment. And passive income, of course, is rarely 100% passive. Often there is considerable time and effort that goes into setting up a passive income stream. And some sources of passive income (from investing, real estate, running a business or creative endeavor) require ongoing maintenance. This story was produced by SoFi and reviewed and distributed by Stacker.

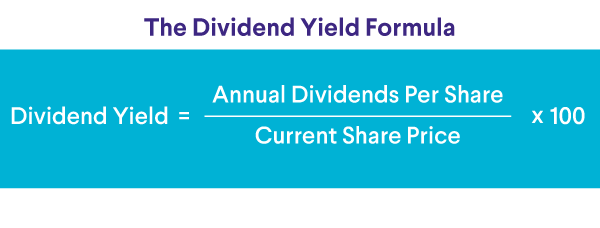

39 passive income ideas to help you make money in 2024